Smaller Independents and Third-Party Originators - Critical Players in Equipment Finance

Smaller Independents and Third-Party Originators - Critical Players In Equipment Finance

Are smaller independent equipment finance companies and third party originators largely ignored in sizing of the industry? I think so. Join me as I have a lively conversation with Michael Toglia, publisher at Equipment Finance Advisors, about why we’re overlooking the origins and “vibrancy of the industry” and how this might just be creating unidentified risk for the bigger players.

Featured in

![]()

Video Interview with Sandhills Global - Disruption in Process

Sandhills Global has been showing up at leasing events for the past couple of years. Some know who they are or think they have an idea. Well, same with me. Today we clear up the question of who and what Sandhills Global is and why we should care. Sandhills has been known for the print publications like Truck Paper, Machinery Trader, TractorHouse, and a lot of others. But so what?

Simply put, Sandhills Global has been working to become a significant disrupter in the core of Equipment Leasing & Finance - equipment resale price optimization and valuation analysis.

Sandhills Global is a prime example of a company morphing from a low-tech to high-tech business model in terms of asset valuations and remarketing of assets and now doing something with all of the data gathered along the way.

Part 1: What is Sandhills Global?

Part 2: From classified print ads to big data?

Part 3: Sandhills Value Prop

Part 4: The impact of disruption!

Part 5: What’s next for Sandhills?

Part 6 Wrapping your mind around Sandhills Global.

Mitch Helman

Scott Lubischer

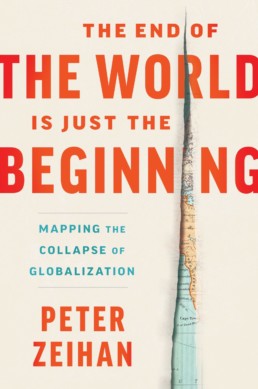

Peter Zeihan - “The End of the World is Just The Beginning”

THE END OF THE WORLD IS JUST THE BEGINNING

Let me be clear, this is a must-read, not for just those in the equipment finance industry but for everyone. There is a paradigm shift afoot, NOW! The sooner we understand it, the sooner we are prepared to capitalize on it. This is not a dour forecast but a reset. You cannot say, "I wish I knew then what I know now," because, well, now you do! Thanks to Peter Zeihan and his first-rate team of researchers.

Peter and Bob discuss his new best-selling book and why understanding what is coming about is vital to EVERYTHING going forward.

Peter is an expert in geopolitics, a prescient sage, albeit young, who has an uncanny way of simplifying the seemingly complex and sometimes insane world we live in.

Part 1: The Impetus for “The End of the World”

Part 2: Peter on being right on the mark for the past 7 years.

Part 3: Please tell me there is a happy ending?

Spoiler Alert! This is not the end of the world! Jeesh! What we need to know to capitalize on the changes in the new supply chains.

Part 4: Peter at ELFA’s October 2022 Convention!

Peter mentions a particular section in the book that we in the leasing industry will want to read!

Video Interview with Dave Schaefer, CLFP – Servicing Leases & Loans, a New Normal?

We caught up with the legendary David T. Schaefer, CFLP, of Orion First to talk to us about the great migration of companies to third-party servicing, and how perception of this alternative to in-house servicing has changed.

Dave’s well-known in the industry, particularly on the operations side of lease and loan servicing, first as president of the fabled Financial Pacific, and later as he started his own operations and servicing firm. He’s currently CEO of Orion First, which he founded twenty years ago, and which offers full-service commercial loan, lease, and contract management, as well as backup servicing and commercial collections.

Bookmark this page and watch this brilliant six-part interview, especially if you are an independent with an eye toward selling your company in the future.

So, Dave tells us how the migration and the perception of this alternative to in-house has morphed. Join us, especially if you are an independent with an eye toward selling your company in the future.

Part 1: Changes in the perception of the acceptance of third-party servicing by the industry

Part 2: Impact of Covid on the perception and mainstreaming of thought of Orion’s customers and prospects

Part 3: When is servicing a competitive advantage for a leasing company?

Part 4: Can using outsource servicing be a contributor to enterprise value of a lessor with the goal of an exit to monetize their long-term investment in their company.

Part 5: The Value of Soc1 Type 2 or better Compliance?

Part 6 What’s to come over the next 3 years from a technology standpoint with respect to servicing?

The Equipment Leasing Opportunity - Community Banks

As Published in Bank Director Magazine on April 13, 2022

Community banks are ignoring the potential of a vast C&I market.

Video Interview with Scott Nelson, Ph.D. – Artificial Intelligence Technology for Independent Lessors

Scott Nelson, Ph.D., President, and Chief Digital Officer, of Tamarack Technology Inc., provides Leasing Avenues with the state of artificial intelligence in the equipment leasing and finance industry. From AI, Machine Learning, and Natural Language Processing to how they can be implemented now, Scott explains how even small lessors can realize substantial benefits. Spoiler Alert: it is now affordable and feasible to implement in under a year.

If you do not understand what AI is or its applicability to our industry, you will want to watch all five short segments of the video interview with Scott.

Part 1: Introduction to Scott and Tamarack Technology

Part 2: What are we talking about when we discuss AI, Machine Learning and Natural Language Processing

Part 3: So, what’s the big deal?

Part 4: Practical examples of applicability for independent lessors desiring to scale

Part 5: The Money Question and Conclusion

Chris Chiappetta Video Interview – Broker to Lessor to Exit – A real life “how to”

Chris Chiappetta, now less than one year after leaving First Midwest Bank, provides his real-life experience and retrospective.

This video interview is a must for brokers and lessors that may have similar aspirations. It is also a must for those who need to think post-acquisition by a bank in order to prepare themselves for life as a banker.

Part 1: The journey from a broker to his first line of credit as a lessor

Part 2: The Exit – How and why the exit happened & life post-acquisition

Part 3: Chris gives a retrospective on his long-term goal of an exit while being a broker.

Part 4: Educating the bank vs being left alone.

Part 5: A SURPRISING ANSWER to what’s next for Chris!

First Financial buys Cincinnati’s largest independent specialty lender

Rick Ross, CEO of Summit Funding Group Inc.

Reid Raykovich Video Interview – Behind the Scenes of the "CLFP"

Reid Raykovich - Behind the Scene of "CLFP"

Executive Director of the CLFP Foundation

One of the objectives of Leasing Avenues is to bring you casually, up close, and personal video interviews with fascinating people in our industry (or outside) that through sheer force of will, passion, and intellect, defied the status quo and created something new! Reid’s story is inspiring!

Part 1: Reid discusses the origins of the CLFP certification

Part 2: Reid talks about how the CLFP body of knowledge, the textbook, and the test itself have evolved over time

Part 3: How rigorous is the exam really and what if any are the ongoing requirements for maintaining the CLFP certification?

Part 4: But who should take the test?

Peter Zeihan - “Covid Vaccine and 2021-2023 Business Forecast”

Peter provides a forecast for the next 3-5 years from his unique geopolitical standpoint given two additional factors.

Peter provides a forecast for the next 3-5 years from his unique geopolitical standpoint given two additional factors.THE COVID VACCINE & THE BIDEN ADMINISTRATION

Peter and Bob examine the economic impact on capital equipment spending and select industry sectors of importance to the equipment leasing and finance industry.

Peter is an expert in geopolitics, a prescient sage, albeit young, who has an uncanny way of simplifying the seemingly complex and sometimes insane world we live in. He answers the questions of “where is this or that country going in the near future?”

Part 1: Overview For This Series & Feeding America

Part 2: Realistic Impact of the COVID Vaccine

Tentative rollout schedule for Covid vaccine. When can we expect a post-COVID vaccine return to normal? What will that look like? Commercial Real Estate – back to the office? Are we now better prepared for the next pandemic?

Part 3: The Biden administration from a geopolitical standpoint

YIKES! What will be the effect on US global involvement, US trade, and our US manufacturers’ supply chain? Reshoring real or myth? Future of US investments in China?

Part 4: Lightning Round – Industry and Equipment Forecast!

Supply chain related … Transportation … Rail … Inland Marine … Manufacturing … Electronics … Oil/Gas – fracking … Corporate Aircraft … Commercial Aircraft … IT & Software … Construction … CRE, and Small Biz

Part 5: Peter’s final thoughts for 2021

SUPPLY CHAIN …. SUPPLY CHAIN … SUPPLY CHAIN